TD₿: Is Bitcoin the Future of Money? (a debate) by Erik Voorhees and Peter Schiff

TL;DR Bitcoin improves on the properties of gold and is less susceptible to price suppression via paper markets.

Hey Bitcoiners,

One of the market mysteries of the last couple of years has been gold’s lackluster performance in the midst of geopolitical uncertainty and multi-decade-high consumer price inflation.

Since the Federal Reserve launched several of its liquidity facilities, announced a QE program of $700 billion dollars, and cut interest rates to zero in March 2020, gold is up only +16.65%. Bitcoin, on the other hand, is up +178.7% over that same timeframe.

This is surprising to see, given that gold is traditionally viewed as a safe haven that investors flock to in periods of war, inflation, global uncertainty, and economic turmoil. This should be gold’s time to shine.

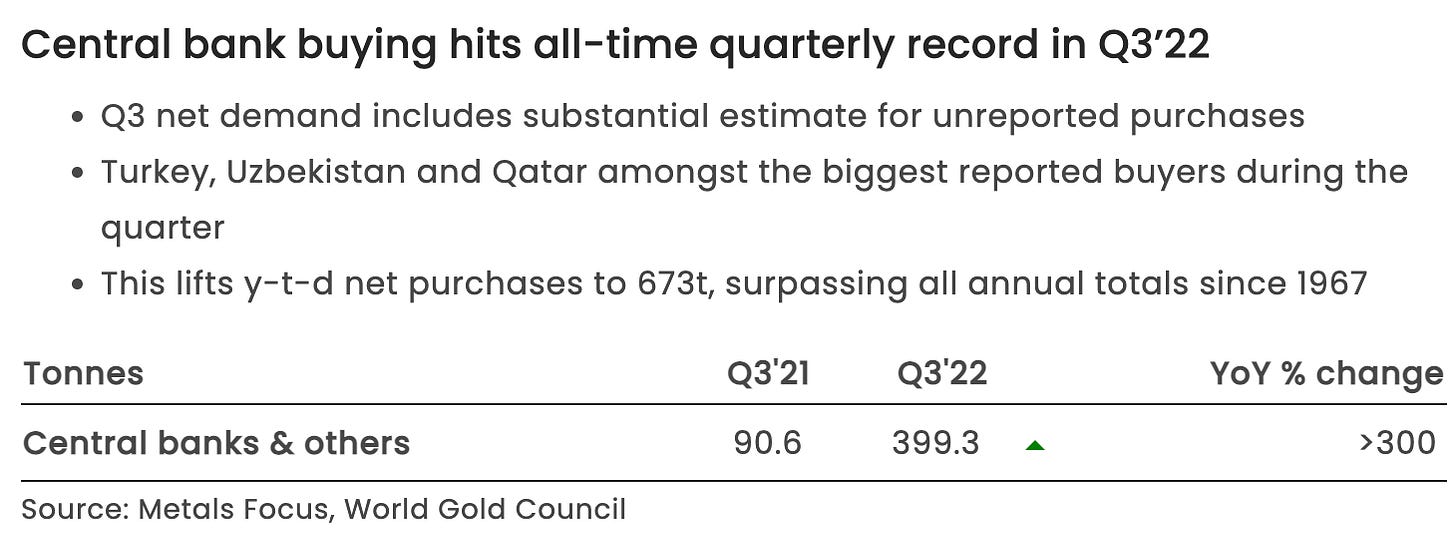

It’s even more shocking when one takes into account recent reports showing record amounts of gold buying from central banks around the world. This year, central banks have purchased 673 tons of gold, the highest total since 1967.

Part of the underperformance of gold can be attributed to the rapid rise in interest rates. Since gold provides no yield, it historically performs poorly in high-interest-rate environments where investors are more attracted to the higher yield provided by bonds and other yield-bearing instruments.

Another possibility is the theory that the price of spot gold continues to be suppressed by paper gold markets. This has been a long, ongoing conspiracy that has become more believable over time as new evidence comes to light and more scandals are exposed. This past August, two former traders at JP Morgan Chase were convicted of “fraud, attempted price manipulation, and spoofing in a multi-year market manipulation scheme of precious metals futures contracts that spanned over eight years and involved thousands of unlawful trading sequences.”

Bitcoin recently just had its own spat with paper markets when FTX claimed it had $1.4 billion dollars worth of bitcoin on its books that turned out to be zero BTC. It was all fake paper Bitcoin IOUs that FTX was selling its customers, artificially inflating the supply in the process.

One can say paper Bitcoin suppressed the price of Bitcoin like gold, but it’s great to see this whole paper shell game collapse in 2 years. These games don’t work well with Bitcoin due to the ease of taking self-custody and its price volatility. Gold is still being suppressed by paper gold with no end in sight. This is just another advantage that Bitcoin has over gold.

It reminds me of this debate between Erik Vorhees and Peter Schiff on Bitcoin vs. Gold that made an impression on me back in the day. (07/19/2018)

Countries are scrambling to get their hands on more gold despite the fact that its price is subject to manipulation and it suffers from the same problems that have plagued it for centuries (lack of portability, divisibility, and auditability).

However, there is one country that is doing things differently. There is one country that is looking toward the future and sees the promise of Bitcoin.👇

It’s only a matter of time before more countries start shifting away from gold and following in the footsteps of El Salvador as they begin to understand Bitcoin’s value proposition as a digital neutral reserve asset.

Tick tock next block,

Sam Callahan

Sign up for Swan and receive $10 in free bitcoin today.

Quote of the Day

“When FTX/SBF stole 70,000 BTC from their customers and sold it, they turned genuine demand into artificial supply 😡.” - Eric Weiss, CEO of the Bitcoin Investment Group

Job of the Day

Synonym is working with a coalition of independent engineers and businesses to bring new integrated products to Bitcoin, using the Lightning Network, Slashtags, and Hypercore protocols. They are looking for a Project Manager to join their talented team. Check it out!

Not your particular skillset? Check out all the Bitcoin jobs at bitcoinerjobs.com.

Featured Event

Tuesday - come hang with Bitcoiners at the Grand Rapids Bitcoiners meetup, where Rev.Hodl will be offering his presentation on “Wealth Diversification with the Eight Forms of Capital.” It will occur from 5:00-8:00 pm at the Factory in Grand Rapids, MI.

Not in town for this? Check out all the Bitcoin events at bitcoinerevents.com.

Meme of the Day

Oh yeah I remember. The debate between Erik Vorhees and Peter Schiff is a classic!

The debate he did with Saifedean Ammous was also good entertainment.

Great read