TD₿: Economic Japanification: Not What You Think by Lyn Alden

TL;DR There are a lot of misconceptions about why Japan hasn't seen significant inflation despite the massive amount of money printing over the years.

Hey Bitcoiners,

A common adage you’ll often hear from many Keynesian and MMT economists is that we can print as much money as we want and not see any inflation…just look at Japan!

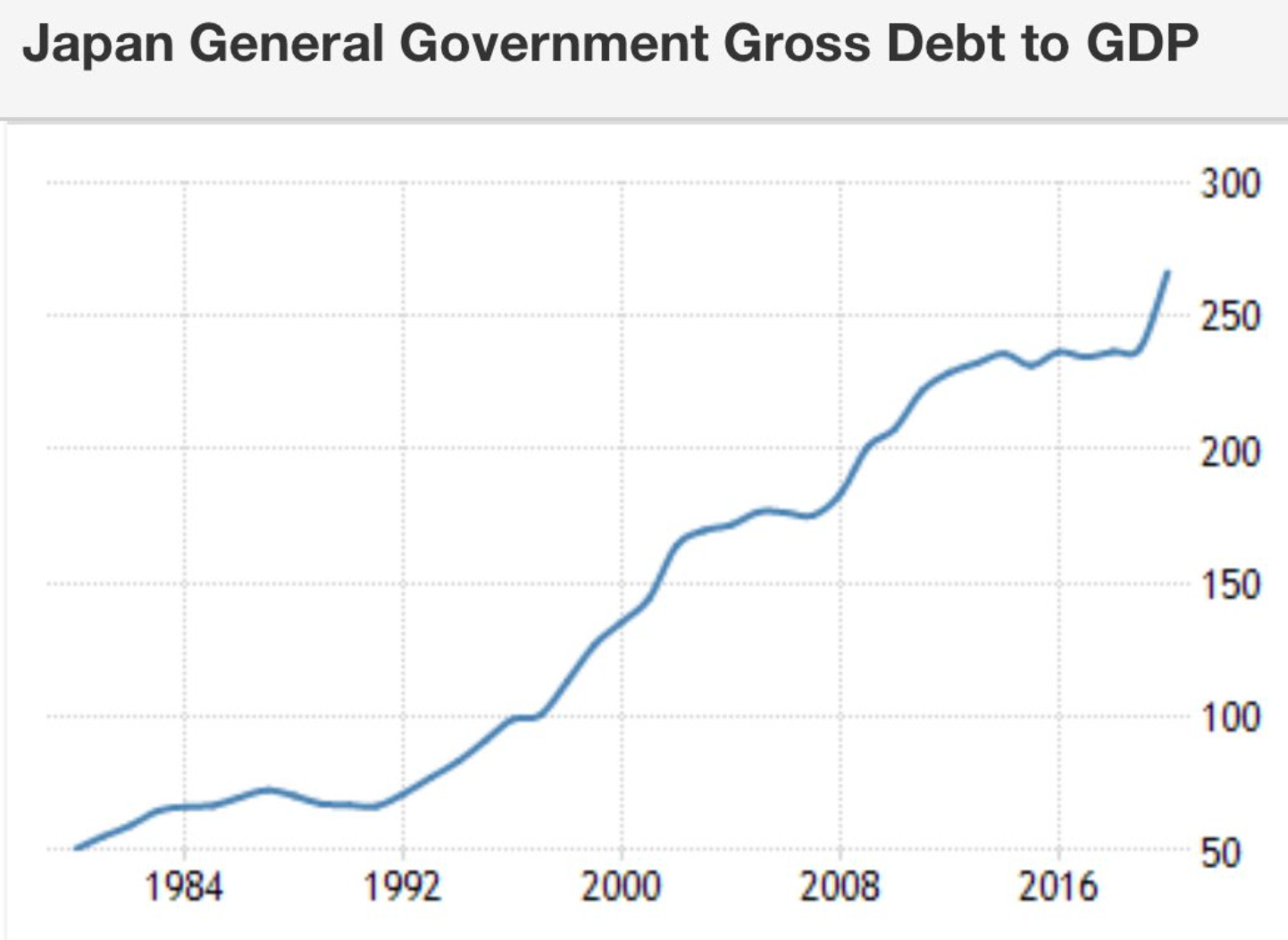

Of course, this refers to the fact that Japan was the first central bank to experiment heavily with QE and has by far the largest debt-to-GDP out of any country (>260%), but has not seen any significant inflation despite this.

In fact, despite this expansion of the Bank of Japan’s balance sheet, Japan has seen deflation and general stagnation in economic growth over the last 30+ years.

However, we are now seeing Japan lose control as inflation has finally started to show up, and they desperately try to manipulate their interest rates through Yield Curve Control.

The Bank of Japan has been pumping an unlimited amount of printed yen into its bond market to try to peg its interest rate at 0.25%. The amazing part? Despite pouring billions and billions of dollars into their bond market, Japan is still struggling to maintain the peg.

As the Bank of Japan continues to perform easy monetary policy right as the Federal Reserves tightens its policy at the fastest pace since 1994, the Japanese yen is now falling under significant pressure. It currently sits at a 24-year low against the dollar.

Japan is finding out in real-time that there is no free lunch in this world, and economists are discovering that perhaps there were other factors at play that kept inflation from rising on Japan’s shores.

Lyn Alden explains this idea further in this brilliant analysis of potential reasons why Japan never saw inflation despite the massive size of its bond-buying programs.

In many ways, Japan can be seen as an early warning sign for the rest of the central banks of the world who think they can blow up their balance sheets with zero consequences.

We are witnessing what can happen when the temptation to print money to overcome economic reality is too enticing to refuse and how eventually, this decision comes home to roost in the form of inflation and currency debasement.

Tick tock next block,

Cory Klippsten

Sign up for Swan and be buying bitcoin in minutes with best-in-class service.

Quote of the Day

“By design, Bitcoin is a strong hedge against currency debasement. If the short-term price action does not reflect this intrinsic monetary property, then consider taking advantage of it.” - Dr. Jeff Ross, Founder and CEO of Vailshire Capital Management

Job of the Day

Looking to break into the industry?! IBEX is looking for an intern to help in its Bitcoin R&D department for 3 months. Sounds like a great opportunity to me for someone young and hungry.

Not your particular skillset? Check out all the Bitcoin jobs at bitcoinerjobs.com.

Event of the Day

Tonight — stop by the Meteor in Austin from 5:30-8:30 pm for food, wine, and some good conversation with Bitcoiners.

Not in town for this? Check out all the Bitcoin events at bitcoinerevents.com.

Meme of the Day

(h/t @LABRAHODL20)