TD₿: Does the National Debt Matter? by Lyn Alden

TL;DR When the fiscal situations of most major developed nations are surveyed today, many appear to be in an unrecoverable fiscal position.

Hey Bitcoiners,

Yesterday the Federal Reserve made waves when it raised the federal funds rate by 0.75%, the highest single interest rate hike since 1994.

This was in response to CPI inflation coming in higher at 8.6% YoY last week and 5-year inflation expectations rising to 3.3% in May.

The Fed is dead set on combating this multi-decade high inflation, and Chairman Jerome Powell is doing his best Paul Volcker impression, but is this really all just a charade?

We’ve touched on this here before, but this is a very different U.S. economy today than the one Paul Volcker had when he spiked interest rates to 20% to stop the great inflation of the 1970s in its tracks.

Back then, U.S. debt-to-GDP was around 30%. Today that number stands at 124%. No matter how big of a game Powell talks about the Fed’s commitment to fighting inflation, this reality is still staring him right in the face.

If interest rates continue to rise in this economy where both sovereign and corporate debt levels are historically high, then the real risk is bankrupting everyone and leading us down a path of a severe recession, if not a depression.

Lyn Alden wrote this thorough write-up looking at the national debt of major countries today and the consequences of high debt-to-GDP ratios (02/01/2022).

As it stands today, the Fed is playing a dangerous game attempting to raise interest rates this aggressively at these debt levels. Time will tell if they will succeed or resort back to the ultra-accommodative policies the economy became addicted to over the past decade.

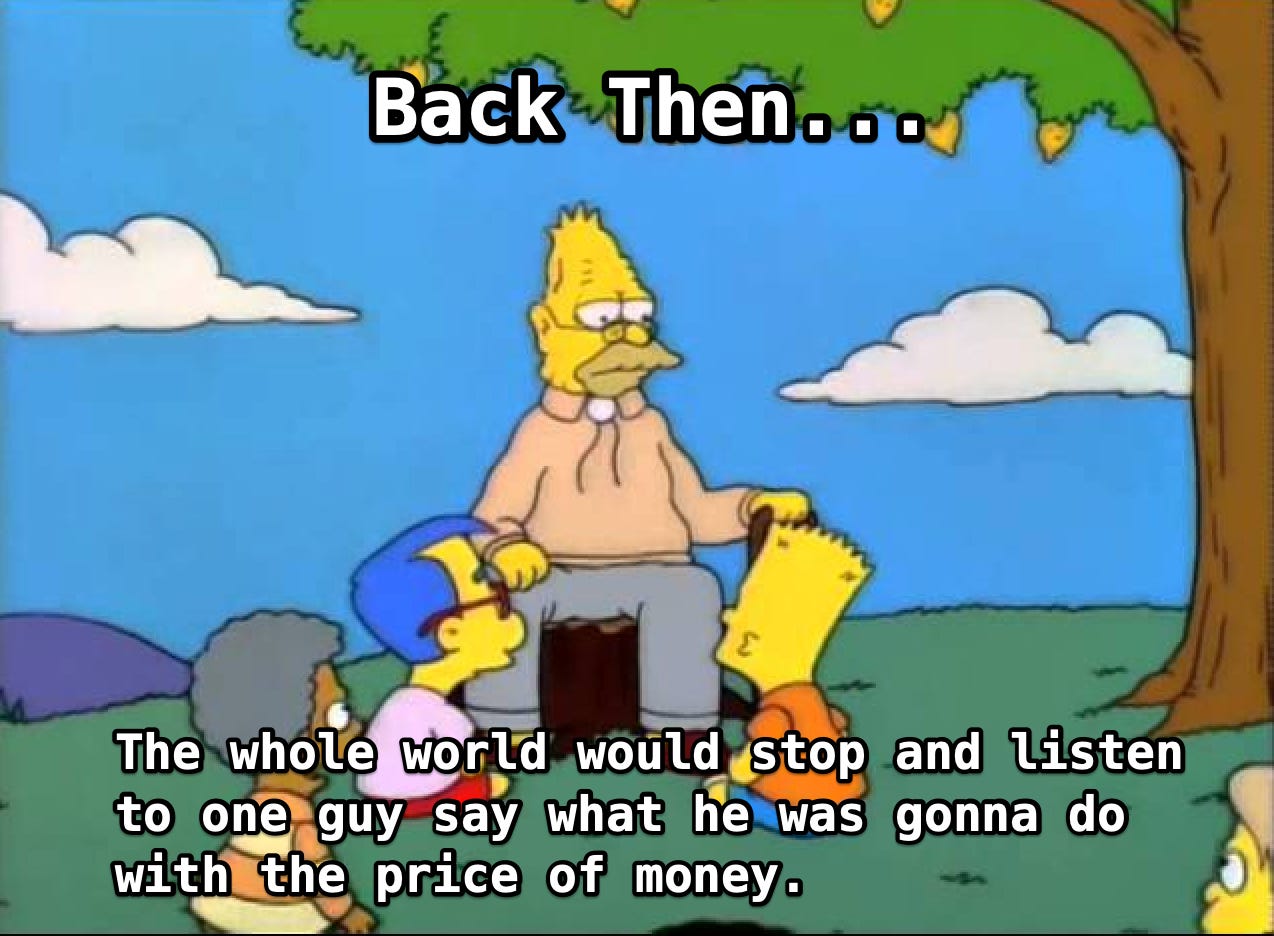

Side note: How ridiculous is it that the entire investment community waits to hear how 12 central planners have decided to manipulate the money in response to these rapidly changing economic conditions?

What an absolute farce.

There’s a better way to manage an economy. There’s Bitcoin and something called the free market.

Tick tock next block,

Cory Klippsten

Sign up for Swan and receive $10 in free bitcoin today.

Quote of the Day

“A failed financial system of central planning by The Federal Reserve is being clung to in America. It was wrong to ignore and replace the sound monetary system created by America's Founders and codified in the U.S. Constitution.” - Ron Paul, Former Congressman from Texas

Meme of the Day