TD₿: Bitcoin Banks by Saifedean Ammous with Caitlin Long

TL;DR With Bitcoin, we don't need the velocity in our payment system to come from leverage anymore.

Hey Bitcoiners,

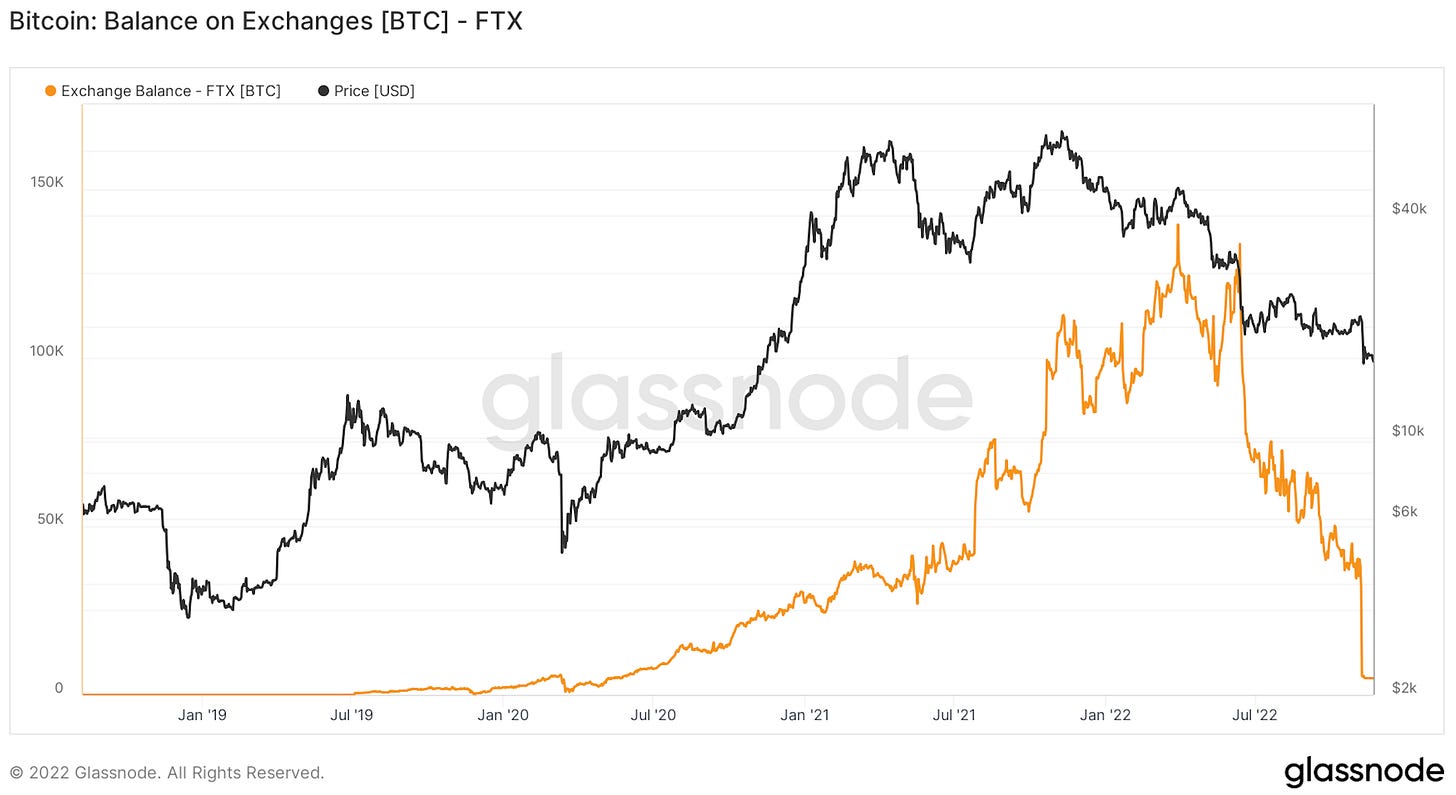

Over the last couple of weeks, we have witnessed FTX go from a $32 billion company to now one of the biggest frauds in the history of finance.

At the end of the day, FTX shows the world what happens when an exchange that is acting more like a fractional reserve bank suffers a bank run.

In a matter of days, billions of dollars worth of user deposits were withdrawn from the FTX platform by rightfully concerned depositors. This was ultimately the final nail in the coffin for FTX.

It’s important to note that this kind of bank run can happen with any fractionally reserved fiat bank today. Even the most well-regulated and conservative fiat bank could not handle that level of deposit withdrawals in such a short period of time. Today, fiat banks have so few reserves that if a significant amount of their depositors asked for their money back, it would likely create an insolvency event, just like FTX.

In fact, as of March 2020, U.S. banks have ZERO reserve requirements!

In other words, as it stands today, U.S. banks can lend out 100% of customer deposits with zero liquidity buffer in the event of a bank run. That means for every $100 that a bank loans out, it is required to hold zero dollars in deposits to back that loan.

It's not really even fractional reserve banking anymore…it's zero reserve banking. That sounds…resilient. 🥴

So why exactly did our current system resort to fractional reserve banking? The reason is we needed to somehow create velocity in our payment systems because payments simply took too long to settle. The best solution to this problem was using leverage to boost velocity.

But Bitcoin fixes this! We can now create velocity in our payment systems through the payment technology itself due to bitcoin being a digital bearer asset and the Bitcoin network being able to quickly settle transactions with finality.

Bitcoin represents a new monetary technology that allows us to build our financial system on a more stable foundation without the destabilizing effects of leverage.

Caitlin Long sat down with Saifedean Ammous and recorded this fantastic podcast where they touch on several of these topics. (10/04/2022)

A non-leveraged financial system is inherently more stable than a leveraged one. In the future, I look forward to a more stable system built on top of the Bitcoin network.

Tick tock next block,

Sam Callahan

PS - I’ve watched this video like 20x. Highly recommend watching this masterpiece from Caitlin if you haven’t already.

Sign up for Swan and receive $10 in free bitcoin today.

Quote of the Day

“Fractional reserve banking and Bitcoin are incompatible.” - Joe Burnett, Head Analyst at Blockware Solutions

Job of the Day

Crowdhealth is looking for a Senior Bank-End Developer to maintain and build new features for our existing customer-facing applications and back-end portal. This individual will also work to create entirely new web applications that interact with our custom API back end and support our internal team and customer base. Check it out!

Not your particular skillset? Check out all the Bitcoin jobs at bitcoinerjobs.com.

Featured Event

Tuesday — come to the Kansas City Bitcoin Meetup at Tanner’s in Shawnee from 6:00-9:00 pm. This meetup will feature a brief agenda discussing the latest happenings in Bitcoin, with plenty of time for socializing.

All levels of Bitcoiners are encouraged to attend!

Not in town for this? Check out all the Bitcoin events at bitcoinerevents.com.

Meme of the Day

100% agreed.

The only difference is that in the TradFi world, people can rely on deposit insurance and the banks can rely on liquidity by the Fed in case of such a bank run event.

But of course only at the cost of continuous credit expansion... history will tell how that story ends. :D

great article, thanks!