TD₿: A Sovereign Debt Bubble Mixed with an Inflation Crisis (a thread) by Stack Hodler

TL;DR Most investors still see Bitcoin as a risk-on play thing, but that will soon change as inflation, debasement, and counterparty risk continue to increase.

Hey Bitcoiners,

The common adage thrown around these days is the Federal Reserve will continue to hike rates “until something breaks,” but what that “something” is exactly is anyone’s guess.

One thing is for sure, the pace of the Fed’s tightening to combat inflation has caused the dollar to spike in a short period of time, which in this highly-leveraged economy, has left a wake of destruction in its path.

Central banks around the world have attempted to raise their own benchmark rates to keep up with the Fed, but it has not been enough to protect their currencies from losing value against the dollar. On top of that, they are constrained with how far they can lift rates without causing significant destruction in the form of a major debt deleveraging event.

After decades of policy errors, central banks have painted themselves into a corner and are now shooting from the hip as they try to keep things from spiraling out of control.

Alarm bells were ringing Sunday night when the British pound fell off a cliff against the dollar to a new all-time low. Add this to the list of major fiat currencies that have devalued rapidly against the dollar in recent months. These advanced-economy currencies are trading like emerging-market currencies right now.

The volatility we have been observing in FX markets lately is simply off-the-charts. Year-to-date, the euro is down -14.62%, the yen is down -20.15%, and the pound is down -20.46%.

This is what I always imagined the end game would look like after the debt-fueled expansion in asset prices we enjoyed since the Global Financial Crisis. The path that central banks and governments have taken us on is unsustainable. It was always likely to result in widespread currency debasement and/or a massive deleveraging event of the global debt bubble.

Stack Hodler wrote this great thread back in June that lays out some of the dynamics at play here and why Bitcoin should be thought of differently from risk assets. (06/16/2022)

Multiple central bankers have described that their future policy decisions will be “data-dependent.” Well, the data isn’t looking good, so prepare for more volatility both in markets and in policy moves from central banks.

These developments will only serve to highlight the stark contrast of fiat currencies to Bitcoin with its fixed supply and predictable monetary policy. In times of currency debasement and inflation, you want to hold scarce assets, and in times of a debt deleveraging event, you want to own assets with no counterparty risk.

It’s only a matter of time before investors wake up and realize that Bitcoin is an asset perfectly suited for these uncertain times.

Tick tock next block,

Cory Klippsten

Sign up for Swan and be buying bitcoin in minutes with best-in-class service.

Quote of the Day

“Currency debasement is the common thread that ties the rise and fall of empires together. For the first time, humanity has money that can't be debased or censored by its government. Everything there is or ever will be divided by 21 million Bitcoin.” - Eternal Values, Bitcoiner

.

Job of the Day

Umbrel is looking for a Software Engineer to help them on their mission to help individuals run Bitcoin full nodes to assist them in becoming more sovereign with their bitcoin and to help improve the decentralization of the Bitcoin network.

Not your particular skillset? Check out all the Bitcoin jobs at bitcoinerjobs.com.

Featured Event

Tuesday — come to BitPlebs LA for some drinks and food at Los Angeles Ale House from 6:30-9:30 pm. All experience levels are welcome!

Not in town for this? Check out all the Bitcoin events at bitcoinerevents.com.

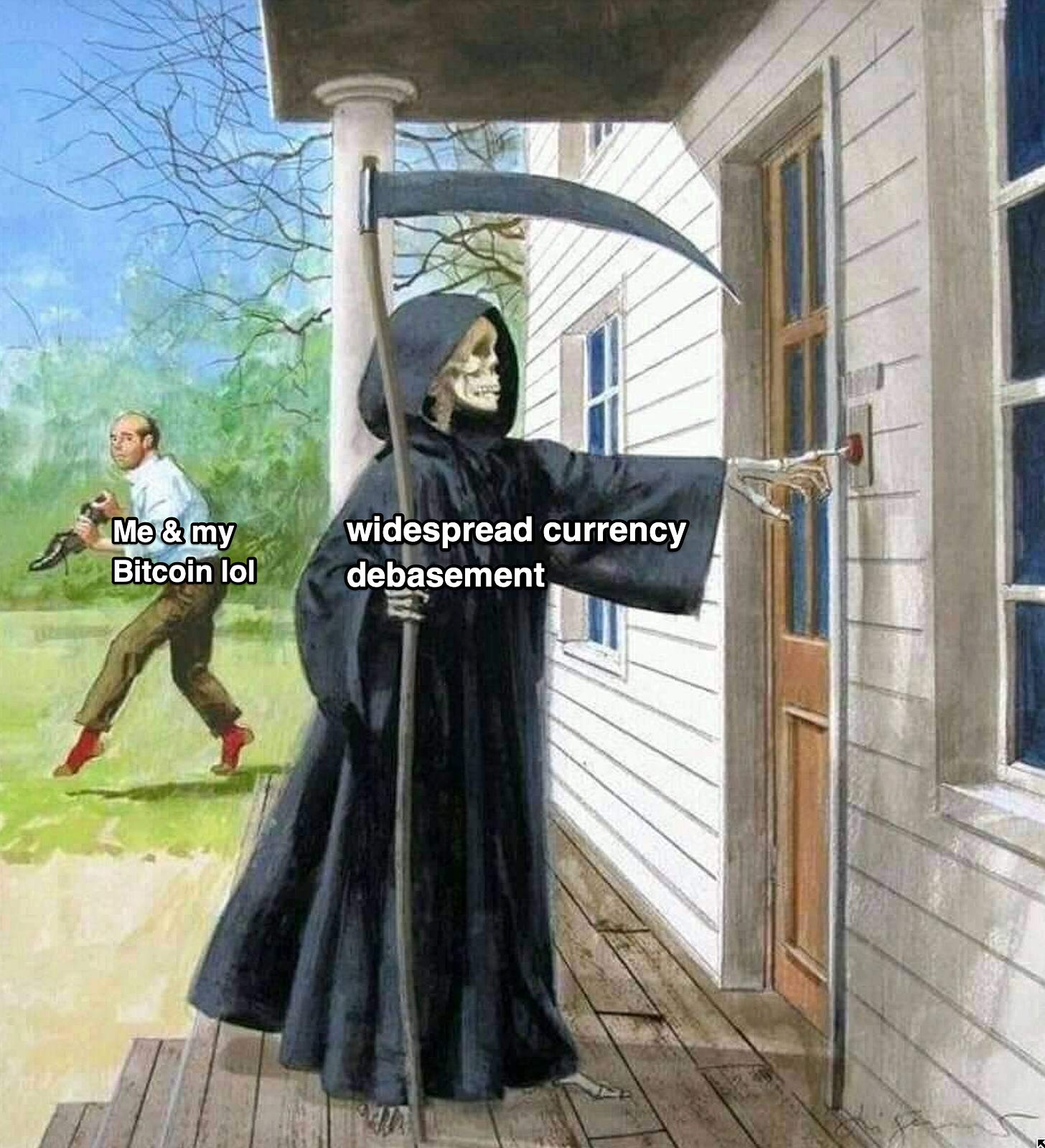

Meme of the Day

Thanks for the quotes and memes. Makes my weekly Facebook orange pilling attempts that much easier/more entertaining. 🙏

The Cantillon Effect is in full force.

https://roundingtheearth.substack.com/p/the-cantillon-effect-is-currency